does georgia have an inheritance tax

However Georgia residents may still be on the hook for inheritance taxes if the state where the deceased lived has legislation. There is the federal estate tax to worry about potentially but the federal estate tax threshhold is current.

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Fortunately unlike some other states Georgia does not have an inheritance tax.

. Though Georgia doesnt collect an. How Much Is the Inheritance Tax. Georgia has no inheritance tax but some people refer to estate tax as inheritance tax.

This means that if you pass away in the state of Georgia your beneficiaries will not. The tax is paid by the estate before any assets are distributed to heirs. Ive got more good news for you.

So Georgians are only responsible for federally-mandated estate taxes in cases in which the. Georgia does not assess and inheritance tax or a gift tax. Georgia Estate Tax and Georgia Inheritance Tax.

More on Taxes and Tax Laws. The state of Georgia eliminated its estate tax effective July 1 2014 and has no inheritance tax. It is not paid by the.

However Georgia residents may still be on the hook for inheritance taxes if the state where the deceased lived has legislation. The good news is that georgia does not have an inheritance tax. This means your children should not have to worry about paying an inheritance tax to the state.

No Georgia does not have an inheritance tax. The good news is that Georgia does not have an inheritance tax. Georgia does not have any inheritance tax or estate tax for 2012.

However it does not mean that any resident of the state is ultimately free from any kind of tax due when they inherit property in Georgia. Most state residents do. Georgia has no inheritance tax but some people refer to estate tax as inheritance tax.

So Georgians are only responsible for federally-mandated estate taxes in cases in which the deceased and their heirs reside in Georgia. It is not paid by the. The tax is paid by the estate before any assets are distributed to heirs.

No Georgia does not have an inheritance tax. No Georgia does not have an inheritance tax. The bad news then is that all other relatives and kids and grandkids receiving property from Pennsylvania and Nebraska may have to pay up.

Suppose the deceased georgia resident left their heir a 13 million worth of an. Georgia has no inheritance tax. If you inherited assets from a deceased loved one you may wonder if you have to pay taxes on the property.

Georgia does not have an inheritance tax.

Center For State Tax Policy Tax Foundation

Estate Planning 101 Your Guide To Estate Tax In Georgia

What Is Inheritance Tax Probate Advance

Georgia Inheritance Laws What You Should Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Estate And Inheritance Taxes Itep

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Does Georgia Have Inheritance Tax

What You Need To Know About Georgia Inheritance Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Georgia Estate Tax Everything You Need To Know Smartasset

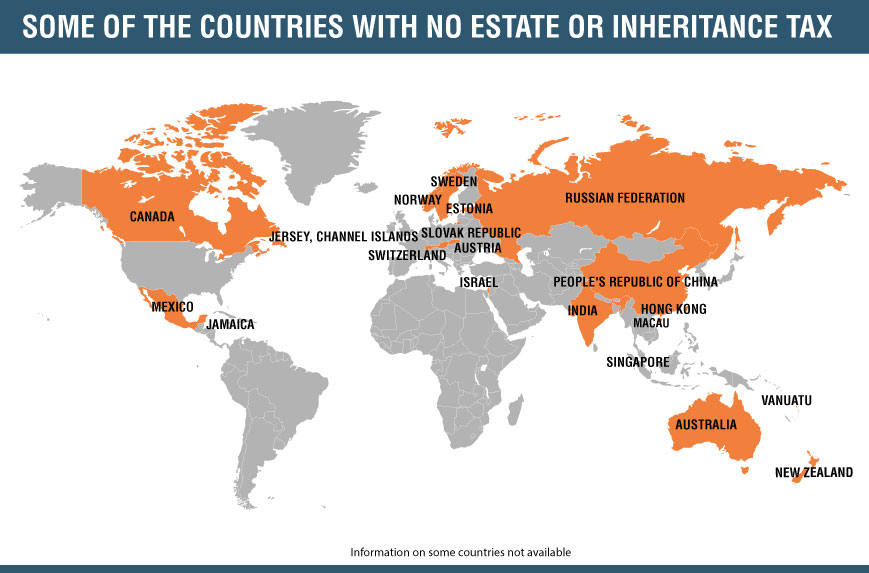

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

State Estate And Inheritance Taxes Itep

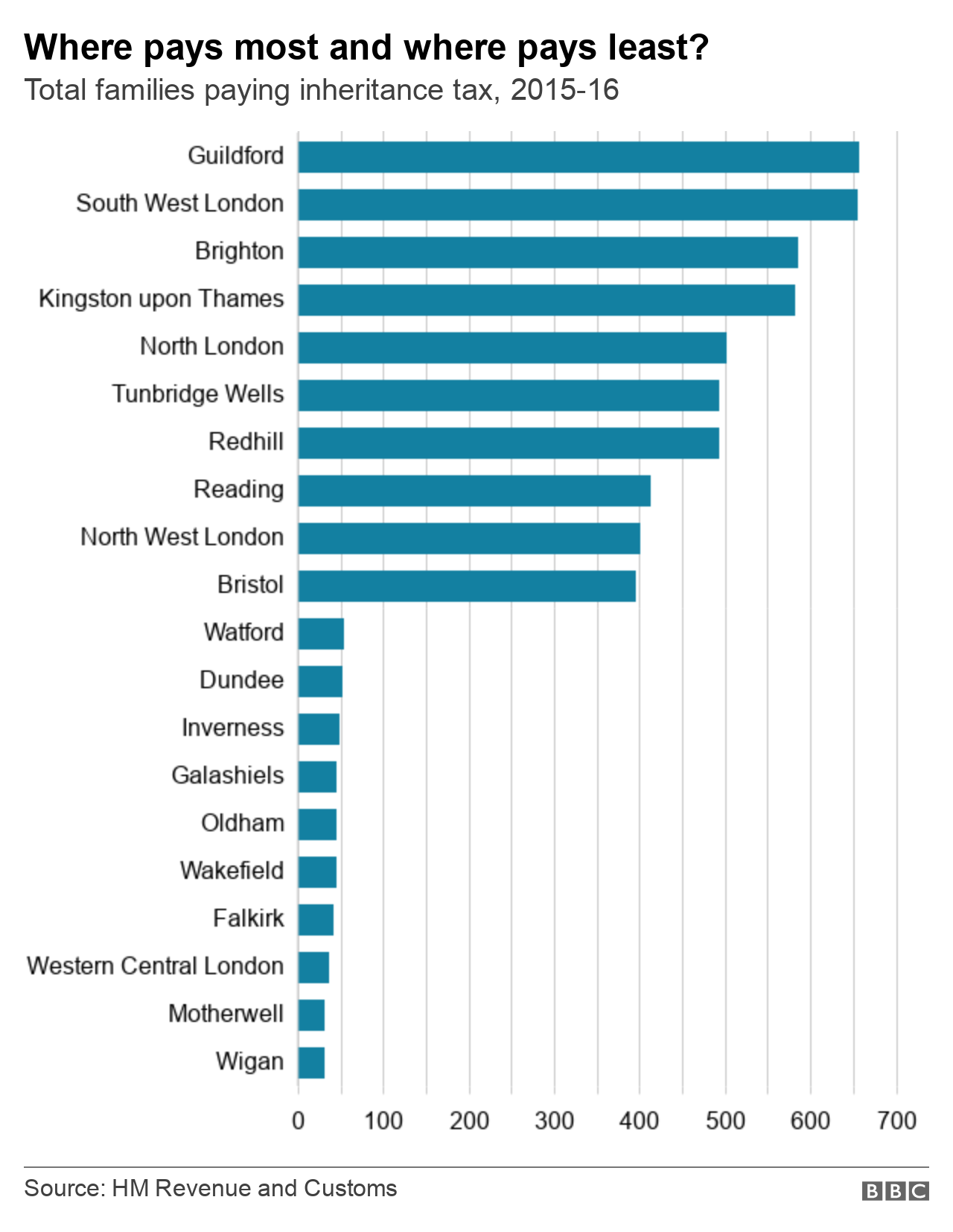

Guildford Is The Inheritance Tax Capital Of The Uk Bbc News

States With No Estate Tax Or Inheritance Tax Plan Where You Die

California Inheritance Tax Inheritance Tax In California Lawyer Legalmatch

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group

Does Georgia Have Inheritance Tax

Washington Has The Nation S Highest Estate Tax Most States Have Gotten Rid Of The Tax Opportunity Washington